Your Guide to the Super Deduction Tax Scheme

What is the super deduction tax scheme and why is it important if you operate a fleet of vans?

If you are planning to finance or buy new vans for your fleet, the 31st March 2023 is a key date for you to consider.

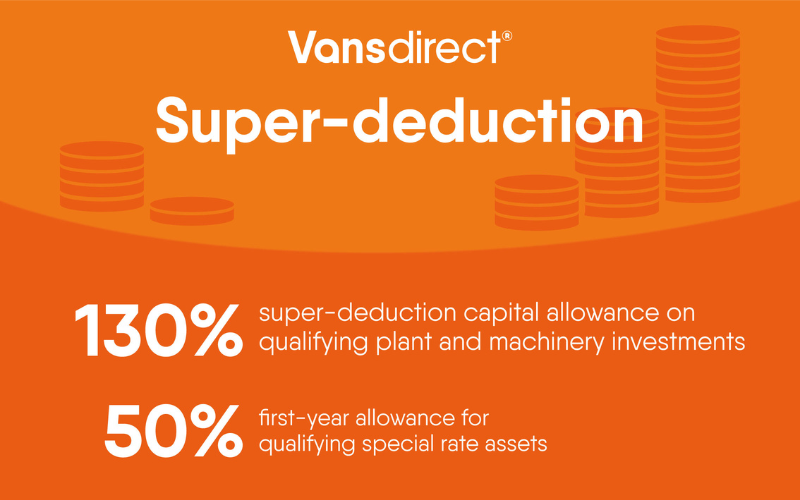

This is because any investment you make in new plant and machinery, which includes vans and commercial vehicles, will qualify for a 130% super-deduction capital allowance, or a 50% first-year allowance (FYA) for qualifying special rate assets.

Expenditure qualifying for the super-deduction would have ordinarily been relieved at the main rate writing down allowance of 18%, while the special rate writing down allowance was 6%.

In real terms, this could mean a tax cut of up to 25p for every £1 invested in qualifying assets according to HMRC.

Sam Ward, Vansdirect managing director commented:

“Those businesses considering changing or adding to their fleet in 2023 should consider their ability to do so before the 31st March 2023 deadline.

Whether you are simply looking at a like-for-like upgrade or considering a switch to electric vans, there could be some financial benefit in making these changes before the deadline.

Where we can help you to get the vans you need from our large pipeline of stock, we would always recommend speaking with your accountant to ensure you are making the right decision for your business.”

According to Gov.uk, you will be eligible for this additional capital allowance if:

- your company is subject to Corporation Tax

- you incurred the expenditure on or after 1st April 2021, but before 1st April 2023

- you did not buy the plant and machinery due to a contract you entered into before 3rd March 2021

At Vansdirect we have over 700 new vans in stock, available for delivery in January and February which will qualify if your business meets the required conditions.

Before committing to any new vans, we would recommend speaking to your accountant to make sure that the super-deduction tax allowance is applicable to any investments planned.

If you would like to discuss your new vans with a member of the sales team, just get in touch on 0344 539 6539.